Have an access code? Explore the platform here

Because Wealth

Should Feel Personal

Nextvestment helps financial institutions deliver personalized, compliant advice — at scale and without re-platforming.

Have an access code? Explore the platform here.

The AI-Native Engagement Layer for Wealth Management

Unifying AI, Portfolio Management, and Compliance within a single, scalable architecture. Nextvestment helps financial institutions deliver personalized investment solutions at scale.

Finance Was Built for Branches.

People Now Live in a Digital-First World.

Modern clients expect more than statements and dashboards — they want personalized conversations, real-time insights, and confidence in their financial future.

But traditional wealth management infrastructure hasn't caught up with digital-first expectations, leaving advisors overwhelmed and clients underserved.

That's where we come in.

What if Every Client Had a Personal Wealth Advisor?

Nextvestment helps banks deliver personalized advice at scale — securely, compliantly and without re-platforming.

Our AI-native platform bridges the gap between human investment advice and digital experiences, enabling every client to receive tailored portfolio insights, real-time market analysis, and personalized investment recommendations, anytime, anywhere.

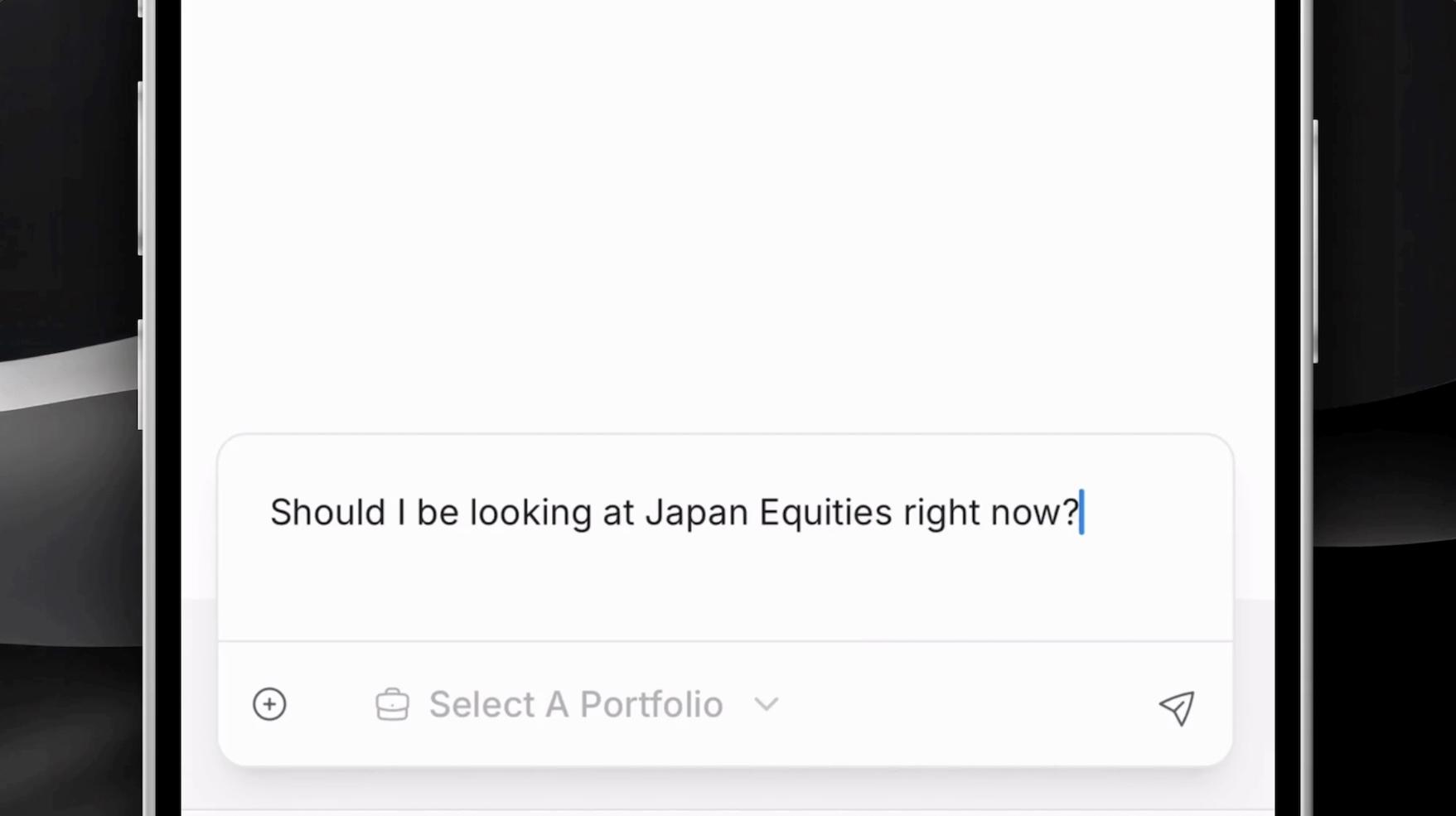

We turn Questions into Signals

and Signals into Outcomes

Here’s what happens when a client asks a question.

Proven Results with Regulated Financial Institutions

Already deployed with leading banks, wealth management firms, brokerages, and family offices, delivering measurable improvements in client engagement and advisor productivity.

$65bn

IN Combined AUM across institutions powered by nextvestment

40%

CLIENT ENGAGEMENT RATE - ACHIEVED WITHOUT OUTBOUND MARKETING

1 in 10 clients

take an investment action after interacting with our tools