Have an access code? Explore the platform here

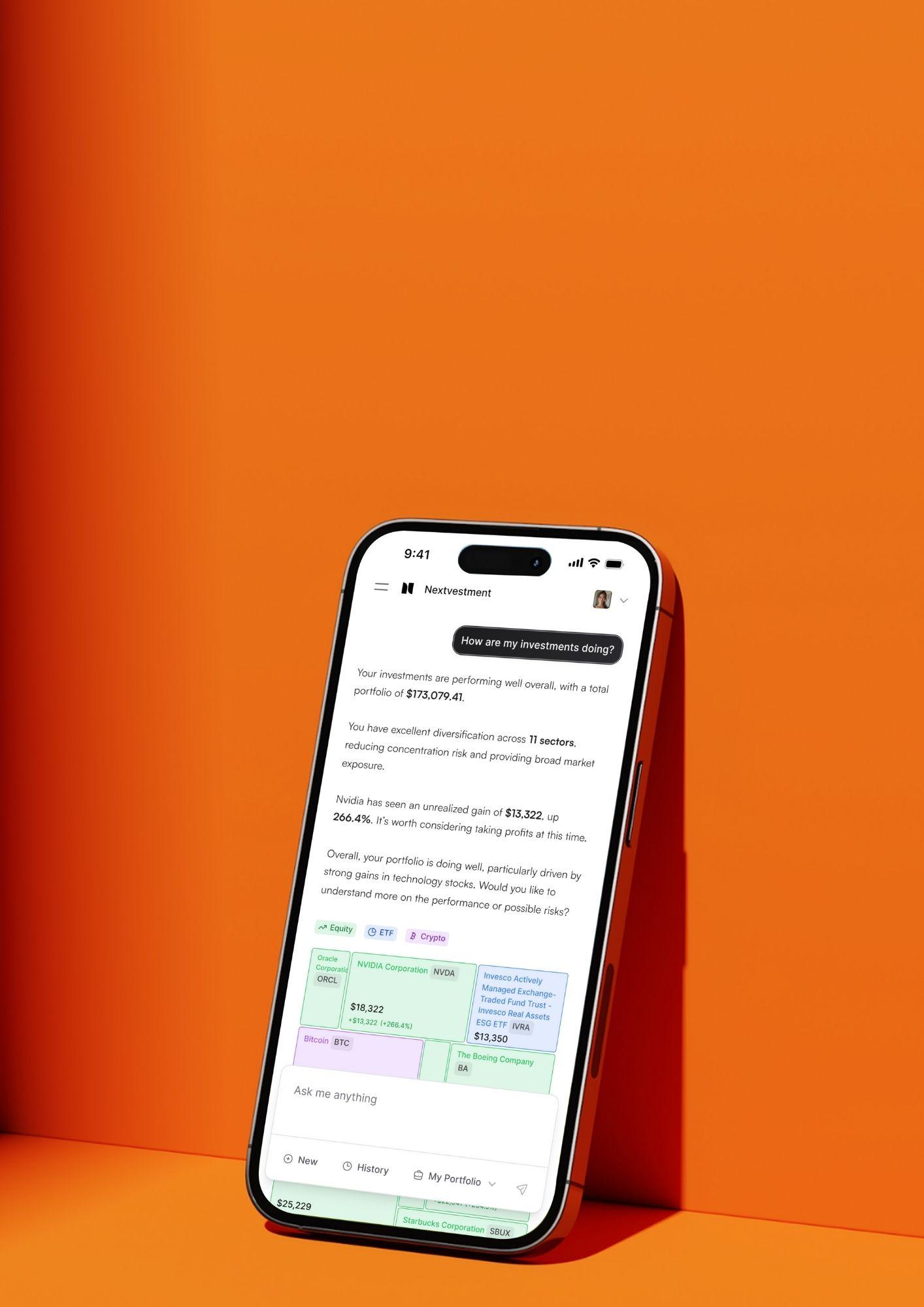

Help Every Client Understand Their Wealth At Scale

The AI engagement layer that turns client questions into personalized guidance — while you stay in control of advice, suitability and house view. Deploy in weeks, not years.

Have an access code? Explore the platform here.

We turn Questions → Signals

and Signals → Outcomes

Here's what happens when a client asks a question.

Your House View.

Your Suitability Rules.

Your Brand.

Nextvestment's AI-native engagement layer ensures every response aligns with your investment philosophy, regulatory requirements, and client suitability profiles. You define the boundaries — we deliver the engagement.

Define Advice Guardrails

Set rules for product suitability, risk tolerance alignment, and asset class recommendations that match your house view.

Maintain Compliance

Automated regulatory disclosures, audit trails, and escalation triggers built into every interaction.

Keep Your Brand

White-label deployment with your colors, logos, and tone of voice. Clients see you, not us.

Proven Results with Regulated Financial Institutions

Already deployed with leading banks, wealth management firms, brokerages, and family offices, delivering measurable improvements in client engagement and advisor productivity.

$65bn

Client AUM Served

Across regulated institutions in Asia and Europe40%

monthly active engagement

8x the industry average for digital wealth tools1 in 10

Conversations lead to an investment action within 7 days

Client action, not just engagement8 Weeks

From kickoff to pilot launch

Integrates with your existing systems - no re-platforming requiredCurrently deploying with institutions in Singapore, Europe, and the US

Trusted by regulated institutions across Asia and Europe

Singapore • Hong Kong • Europe • US