Have an access code? Explore the platform here

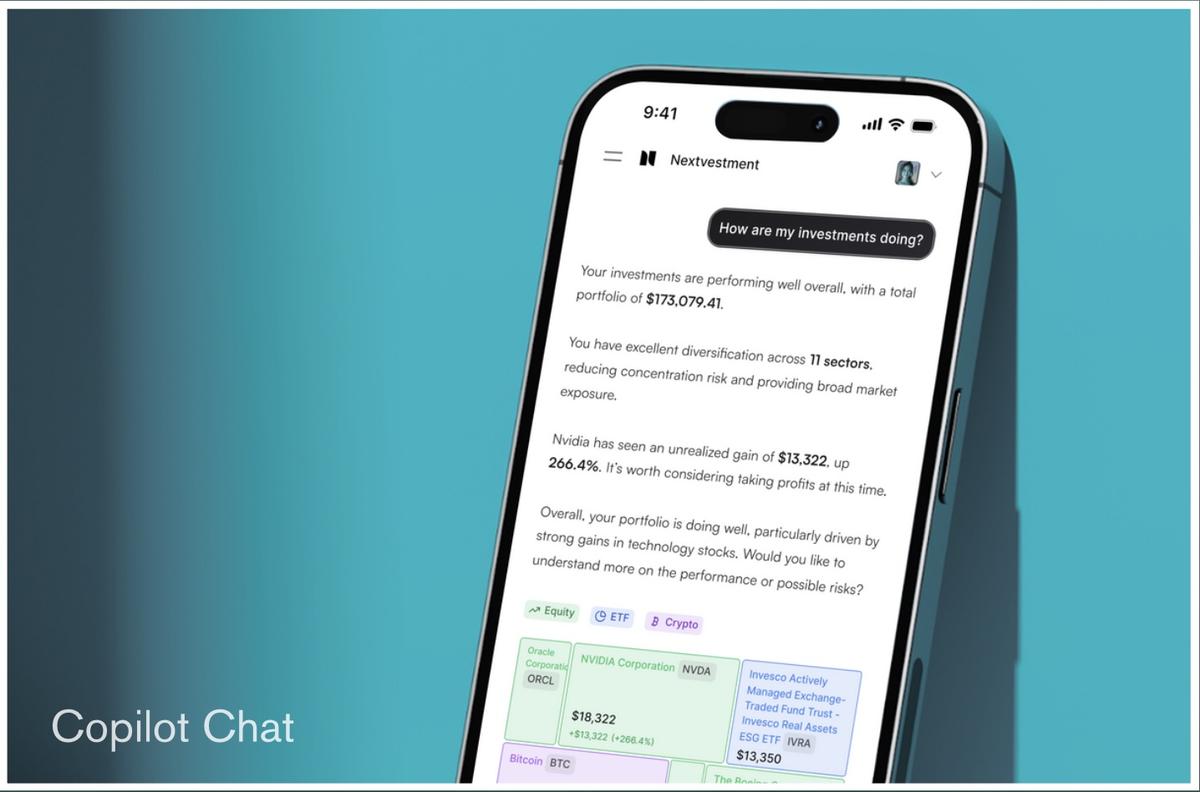

The AI-Native Engagement Layer for Wealth Management

Turn every client question into actionable insight — securely, compliantly, and at scale.

Have an access code?Explore the platform here.

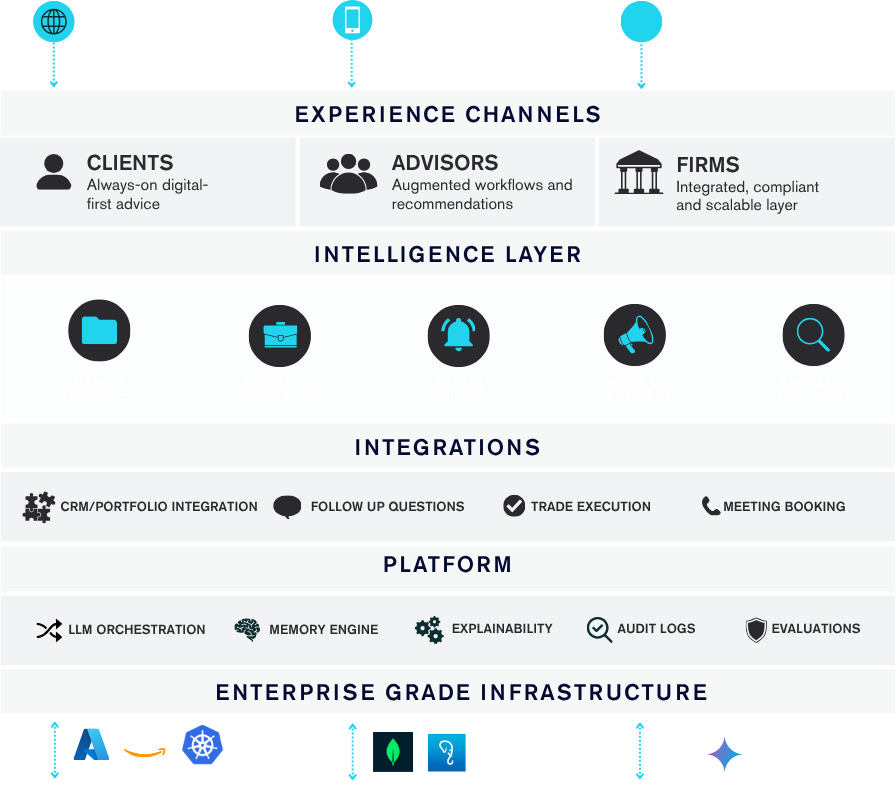

The Intelligence Layer Behind AI Wealth Management

Enterprise-grade architecture for wealth management automation — personalized conversations, portfolio analysis, and prospecting tools for financial advisors, all integrated seamlessly into your existing systems.

Built for How You Work

For Banks

Your digital channels already have thousands of clients asking questions your call center can't scale to answer. Nextvestment handles the first response — grounded in their actual portfolio, not generic FAQs — and flags conversations that need human advice.

Key outcomes:

- 8x engagement vs. static digital tools

- 15% of AI conversations convert to RM meetings

- Zero increase in call center volume

For Wealth Managers

Self-directed clients don't stay self-directed forever. Our intent detection identifies the moment they're ready for advice — so your RMs reach out before the client calls a competitor.

Key outcomes:

- 3x more advised relationships from existing client base

- RMs spend time on warm leads, not cold outreach

- Higher AUM per client

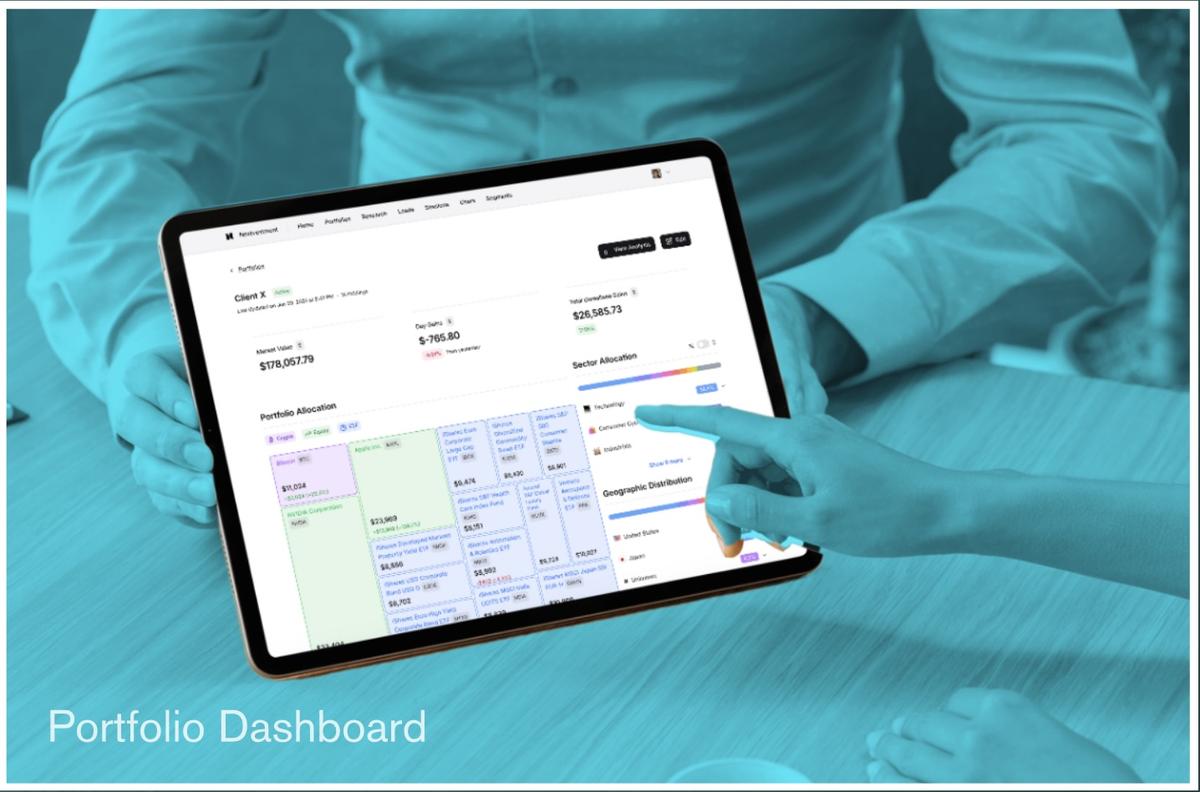

For Family Offices

Principals want answers, not dashboards. They ask "how did we perform versus benchmark?" and get an instant answer across all custodians — without your team spending half a day pulling reports.

Key outcomes:

- 80% reduction in ad-hoc reporting requests

- Faster principal responses

- Staff time redirected to analysis, not data gathering

Client Behavioral Intelligence

Every client interaction is a signal. We capture, score, and route them to your advisors.

Signals We Capture

- ● Question topics (retirement, risk, specific sectors)

- ● Engagement frequency and depth

- ● Portfolio concerns and life events

- ● Sentiment and urgency

How Signals Become Actions

- ● Scored and prioritized lead lists for RMs

- ● Automated meeting prep with context

- ● Recommended talking points and next-best-actions

- ● Trigger alerts for high-value opportunities

Example: Client asks about retirement timeline → flagged as life event → RM receives briefing with portfolio recommendations and meeting agenda.

Start with a pilot.

Most institutions begin with 2,000–5,000 clients in a single segment. See results in 6 weeks, then decide whether to expand. No long-term commitment required until you've validated the outcomes.

How Institutions Deploy Nextvestment

Our modular wealth management platform integrates directly into existing workflows — connecting client insights, advisor actions, and firm systems across all channels without disrupting your current infrastructure.

Proven Results with Regulated Financial Institutions

Already deployed with leading banks, wealth management firms, brokerages, and family offices, delivering measurable improvements in client engagement and advisor productivity.

$65bn

Client AUM Served

Across regulated institutions in Asia and Europe40%

monthly active engagement

8x the industry average for digital wealth tools1 in 10

Conversations lead to an investment action within 7 days

Client action, not just engagement8 Weeks

From kickoff to pilot launch

Integrates with your existing systems - no re-platforming requiredCurrently deploying with institutions in Singapore, Europe, and the US